Microsoft’s monumental $170 billion deal marks a transformative moment for the tech giant. It solidifies the company’s dominance in cloud computing and artificial intelligence (AI).

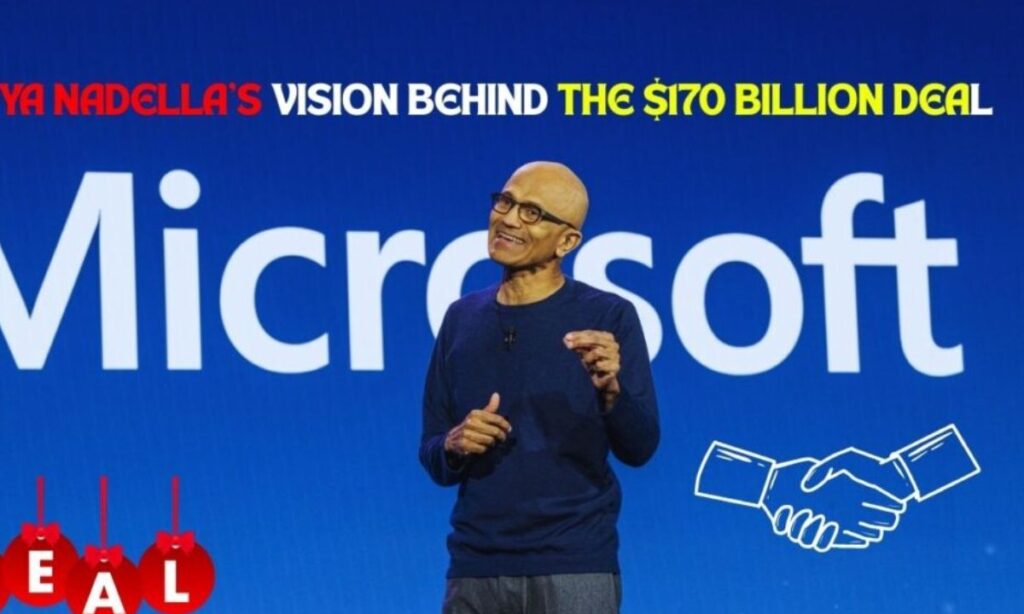

Under CEO Satya Nadella’s leadership, Microsoft is poised to leverage this significant investment for future growth. This deal not only signals Microsoft’s commitment to innovation but also aims to enhance its global presence.

By focusing on key technologies, Microsoft plans to meet the evolving needs of businesses worldwide. In this blog post, we will explore the key aspects of this landmark deal and the role of Dealogic in making it possible.

Overview of Microsoft’s $170 Billion Deal

- Microsoft’s $170 billion deal represents a historic moment in the tech landscape.

- The deal cements Microsoft’s status as a powerhouse in cloud computing and artificial intelligence (AI).

- CEO Satya Nadella provides visionary leadership to harness this financial commitment for growth.

- The investment is aimed at driving innovation and expanding Microsoft’s global presence.

- Key aspects of the deal will be explored, highlighting Nadella’s strategic vision.

- Dealogic plays a crucial role in facilitating this significant transaction.

Key Aspects of the $170 Billion Deal

The $170 billion deal focuses on enhancing Microsoft Azure, advancing AI technology, acquiring key companies, and expanding global market reach.

Cloud Infrastructure Growth

This deal will significantly enhance Microsoft Azure, making it a stronger competitor against AWS and Google Cloud.

By improving its infrastructure and services, Azure can meet the growing demand for cloud solutions. This investment aims to solidify Microsoft’s position in the enterprise cloud market.

Artificial Intelligence Expansion

Microsoft is focused on becoming a leader in artificial intelligence through this deal. It plans to drive advancements in AI technology that will improve its products and services. These improvements will help businesses operate more efficiently and effectively.

Acquisition of Key Players

The deal may include the acquisition of companies that align with Microsoft’s strategic goals in AI and cloud computing.

By bringing in innovative firms, Microsoft can quickly enhance its technological capabilities. This will allow for a broader product portfolio and stronger market competitiveness.

Global Market Reach

This massive investment aims to expand Microsoft’s presence in key international markets. By targeting these regions, Microsoft can access new customer bases and opportunities. Strengthening its global influence will help Microsoft serve a diverse range of clien

Satya Nadella’s Vision Behind the $170 Billion Deal

Satya Nadella has been at the helm of Microsoft since 2014, steering the company away from its traditional software focus toward becoming a leader in cloud services and digital transformation.

His vision encompasses a cloud-first, AI-first strategy, aiming to push Microsoft deeper into the global technology arena.

This $170 billion deal is a key component of that strategy, showcasing his ambition to transform Microsoft into a dominant player in the industry.

How Satya Nadella Orchestrated the Deal

Satya Nadella orchestrated the $170 billion deal by strategically enhancing Microsoft’s cloud and AI capabilities.

His leadership and experience in previous acquisitions positioned the company for growth and market leadership.

Focusing on Cloud and AI

Nadella’s emphasis on cloud computing and AI is crucial for Microsoft’s growth strategy. This deal signifies an effort to further expand these areas, ensuring Microsoft remains competitive.

Acquisition Strategy

Nadella has demonstrated his ability to make significant acquisitions, with notable purchases like LinkedIn and GitHub.

This deal represents the next logical step in his strategy to enhance Microsoft’s capabilities and market presence.

Global Expansion

Under Nadella’s leadership, Microsoft has experienced rapid international growth. This transaction is designed to further solidify its global presence, especially in emerging markets eager for innovation.

Nadel la’s Leadership Success

Cultural Transformation

Nadella transformed Microsoft’s corporate culture to foster collaboration and inclusivity.

He encouraged open communication and transparency among employees. This cultural shift has led to increased employee engagement and satisfaction.

Focus on Cloud and AI

Under Nadella’s leadership, Microsoft prioritized cloud computing and artificial intelligence as key growth areas.

The successful launch of Azure positioned Microsoft as a leader in the cloud market. This focus has opened up new revenue streams and business opportunities.

Emphasis on Innovation

Nadella encourages a culture of innovation within Microsoft, pushing teams to explore new ideas and technologies. He has promoted the development of cutting-edge products and features.

This emphasis on innovation keeps Microsoft competitive in a rapidly changing tech landscape.

Strategic Acquisitions

Nadella has successfully overseen several strategic acquisitions, including LinkedIn and GitHub. These acquisitions have strengthened Microsoft’s capabilities and market position.

They also align with Microsoft’s goals in social networking and software development.

Strong Financial Performance

Since Nadella took over, Microsoft has experienced significant growth in market value and revenue. His leadership approach has driven consistent financial performance and shareholder value.

This success showcases the effectiveness of his strategies and vision for the company.

The Role of Dealogic in Facilitating Microsoft’s $170 Billion Deal

Dealogic played a crucial role in facilitating Microsoft’s $170 billion deal by providing critical financial data and analytics for strategic decision-making.

Its platform enabled efficient execution and assessment of potential acquisition targets, enhancing Microsoft’s capacity to navigate complex transactions.

What is Dealogic?

Dealogic is a leading financial market data and analytics platform used primarily for mergers and acquisitions (M&A). It provides investment firms with the tools required to execute complex transactions effectively.

How Dealogic Helped Microsoft Execute the Deal

Dealogic played an essential role in supporting Microsoft throughout the execution of this monumental deal.

It provided M&A support, helped Microsoft assess potential acquisition targets, and offered market insights crucial for understanding investor sentiment and ensuring optimal timing.

Why Dealogic is Essential for Large-Scale Transactions

Dealogic is essential for large-scale transactions because it provides critical financial data and analytics. This information helps companies evaluate potential deals and understand market trends.

With accurate insights, organizations can make informed decisions and mitigate risks during complex transactions.

ALSO READ THIS BLOG :“Master the Art of Drawing:uqp7yroofp0= monkey – Your Ultimate Fun and Easy Guide for Beginners!”

Additionally, Dealogic’s platform streamlines the entire transaction process. It offers tools for deal structuring, pricing, and execution, making it easier for teams to collaborate. By facilitating efficient communication and access to data, Dealogic enhances the likelihood of a successful large-scale deal.

Satya Nadella’s net worth?

As of 2023, Satya Nadella’s net worth is estimated to be around $400 million, reflecting his successful tenure as CEO of Microsoft and substantial stock holdings.

His wealth has grown significantly over the years due to Microsoft’s strong performance in the tech industry and strategic business decisions.

| Year | Estimated Net Worth (in millions) |

| 2019 | $250 |

| 2020 | $300 |

| 2021 | $320 |

| 2022 | $350 |

| 2023 | $400 |

Implications of the $170 Billion Deal for Microsoft and the Tech Industry

The $170 billion deal positions Microsoft as a dominant force in cloud computing and AI, significantly impacting competitive dynamics in the tech industry. Additionally, it may catalyze increased mergers and acquisitions, fostering innovation and growth across various sectors.

Strengthening Microsoft’s Cloud Dominance

The deal will enhance Microsoft Azure, helping it lead the enterprise cloud market. This investment allows Azure to improve services and compete better with AWS and Google Cloud.

Businesses will benefit from more robust cloud options. Overall, this will strengthen Azure’s standing in the industry.

Accelerating AI Development

Microsoft aims to drive innovation in artificial intelligence through this deal. It will develop advanced AI technologies that transform business operations.

Focusing on AI will allow Microsoft to integrate smarter features into its products. This shift will promote wider AI adoption across industries.

Mergers and Acquisitions Surge

This deal may trigger a wave of mergers and acquisitions in the tech sector. Competitors will need to adjust to Microsoft’s bold strategy. This could lead to further market consolidation. As a result, the competitive landscape may shift dramatically.

Impact on Startups and Innovation

Microsoft’s investment is likely to foster innovation among tech startups. By partnering with and acquiring these companies, Microsoft can support new ideas.

This collaboration provides startups with valuable resources. Ultimately, it boosts creative advancements in the industry.

Global Market Expansion

Microsoft will expand its presence in key international markets. This growth opens up new customer bases around the world.

By tailoring its services to regional needs, Microsoft can better serve global clients. This solidifies its position as a leading tech company.

Frequently Asked Questions?

WHO is Microsoft’s Founder?

Microsoft was founded by Bill Gates and Paul Allen in 1975. They aimed to develop software for personal computers.

Who is Microsoft’s Chairman?

The current chairman of Microsoft is Satya Nadella, who also serves as CEO. He became chairman in 2021.

Who is Microsoft’s Owner?

Microsoft is a publicly traded company owned by its shareholders. No single person owns the company, but Bill Gates is a major stakeholder.

Who is the current CEO of Microsoft?

Satya Nadella is the current CEO of Microsoft, appointed in February 2014. He has focused on cloud services and artificial intelligence.

What is Satya Nadella’s Education?

Nadella has a Bachelor’s degree in Electrical Engineering from the Manipal Institute of Technology. He also holds a Master’s in Computer Science and an MBA from the University of Chicago.

Who former CEO of Microsoft?

Steve Ballmer was the former CEO of Microsoft, serving from 2000 to 2014. His tenure saw the company expand its product range but struggle in mobile markets.

What is Satya Nadella’s Salary?

Satya Nadella earns an estimated salary of $2.5 million as of 2023. His total compensation is much higher due to bonuses and stock options.

Conclusion

Microsoft’s $170 billion deal significantly strengthens its position in cloud computing and artificial intelligence. This investment enhances Microsoft Azure and promotes innovation in AI technology. It reflects the company’s commitment to providing advanced solutions for its customers and sets the stage for future growth.

Additionally, the deal may reshape the tech industry by triggering more mergers and acquisitions. Companies will likely respond to Microsoft’s strategy, fostering innovation and supporting startups. Overall, this deal will have a lasting impact on the competitive landscape of the technology sect

David is a seasoned SEO expert with a passion for content writing, keyword research, and web development. He combines technical expertise with creative strategies to deliver exceptional digital solutions.